Together with

Hey there 👋,

In this week’s newsletter, I discuss:

Empire Flippers going international

Publishing 90K+ words on Content at Scale

The Financialization of NFTs

Voting on Opepen Sets

Buying an exact match (web2) crypto domain

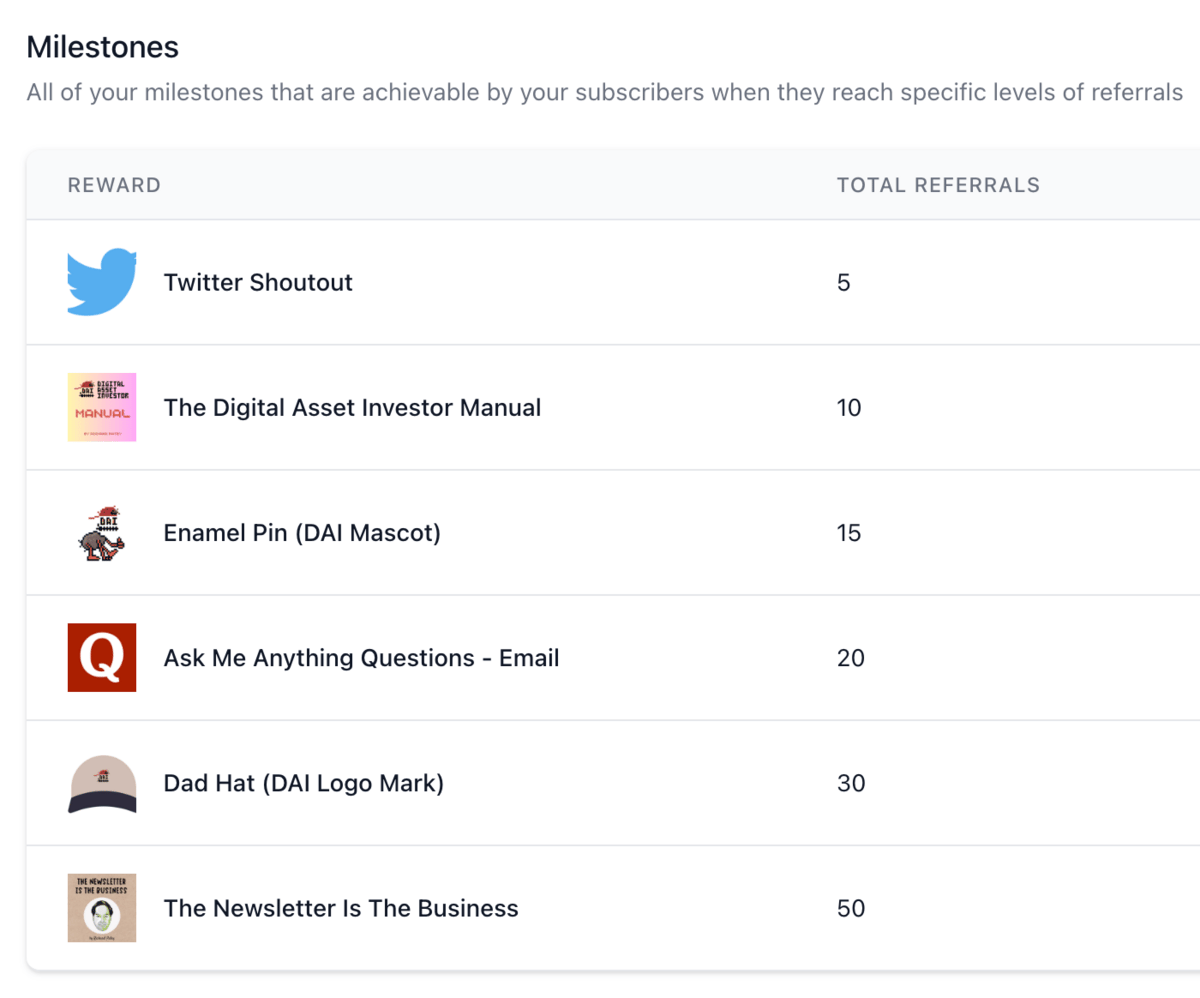

Don’t forget to use your referral link at the bottom of this email if you want some great merch I’m ordering - enamel pins with the DAI mascot and dad hats are currently being made up, with more to come in time 🙂

Cheers!

Richard Patey - @richardpatey

CONTENT SITES

🇪🇸 Empire Flippers Goes International

Justin at Empire Flippers just announced that they are now accepting non-English sites, giving marketplaces like Dot Market some competition:

We've decided to now accept non-English sites at Empire Flippers.

We want to bridge the gap between the US and the non-Enlglish market, which is a real blue ocean. A lot of high-quality sites there to be bought and sold!

Let me know if you have any questions 👇

— #Justin Cooke (#@EmpireFlippers)

3:03 PM • May 3, 2023

🥲 Not Paying Writers over $7K

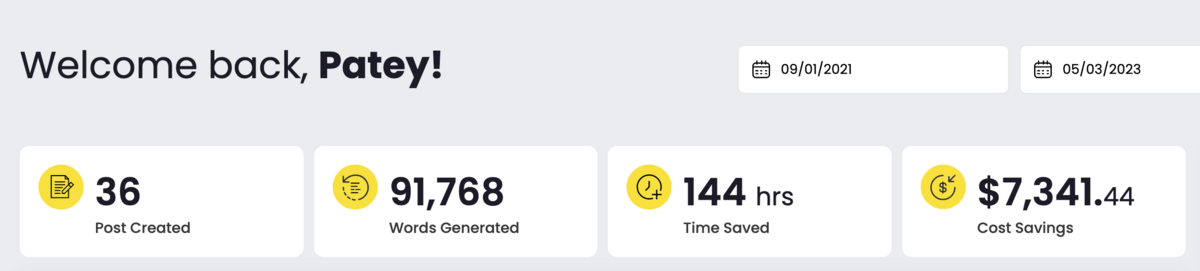

I’ve been publishing content back on my old personal site at richardpatey.com and at acquire.gg using Content at Scale (CaS) and am now at almost 100K words published:

It’s great to see how much time and money I’ve saved using the platform - over $7K in not having to pay writers. I’m editing each piece, some very lightly, some quite heavily, and they are indexing well.

Once this content starts to rank, I’ll be adding CTAs to sign up to my newsletters, using the websites as a funnel for subscriber growth (as I break down in The Newsletter Is The Business).

And CaS have announced a new paid trial offer at just $39.99 where you can generate a 2900+ word article from a keyword or an existing blog post, and keep adding sections or rerunning the thing until you’re happy with the output.

🚀 The #1 Website Broker on Flippa

Thinking of listing your website on the Flippa marketplace? Or already listed, but not getting any serious offers?

Joe Burrill and his team at Just Website Brokerage will be able to change that for you. They don't do listing fees and only charge when they successfully find you a buyer.

If you choose them you will get:

A trusted account with 10 years of history, $3.5M transacted across 162 deals, 100% positive feedback, and thousands of watchers

An optimized listing page with all sales info and attachments, plus use of their legal documents used on 100’s of deals

A listing manager that will field all messages, comments, bids and sales calls with buyers

Promotion to their email list with thousands of buyers

Thanks to Just Website Brokerage for sponsoring this issue 🙏

NFTs

🏦 The Financialization of NFTs

The biggest news in the NFT space over the last week has been the Blur marketplace launching Blend:

1/ Blur Lending, aka Blend, is NOW LIVE.

If you have a Punk, you can now borrow up to 42 ETH within seconds.

If you want an Azuki, you can now buy one with just 2 ETH up front.

Points have been updated as well. Learn more 👇

— #Blur (#@blur_io)

6:19 PM • May 1, 2023

It’s a peer-to-peer lending protocol with market determined interest rates and no oracle dependency (i.e. no need to ping Chainlink to see what the collection price is). People can take loans against their NFTs and then use the ETH elsewhere or to lever up and buy more NFTs. There is no due date or fixed liquidation price like BendDao has.

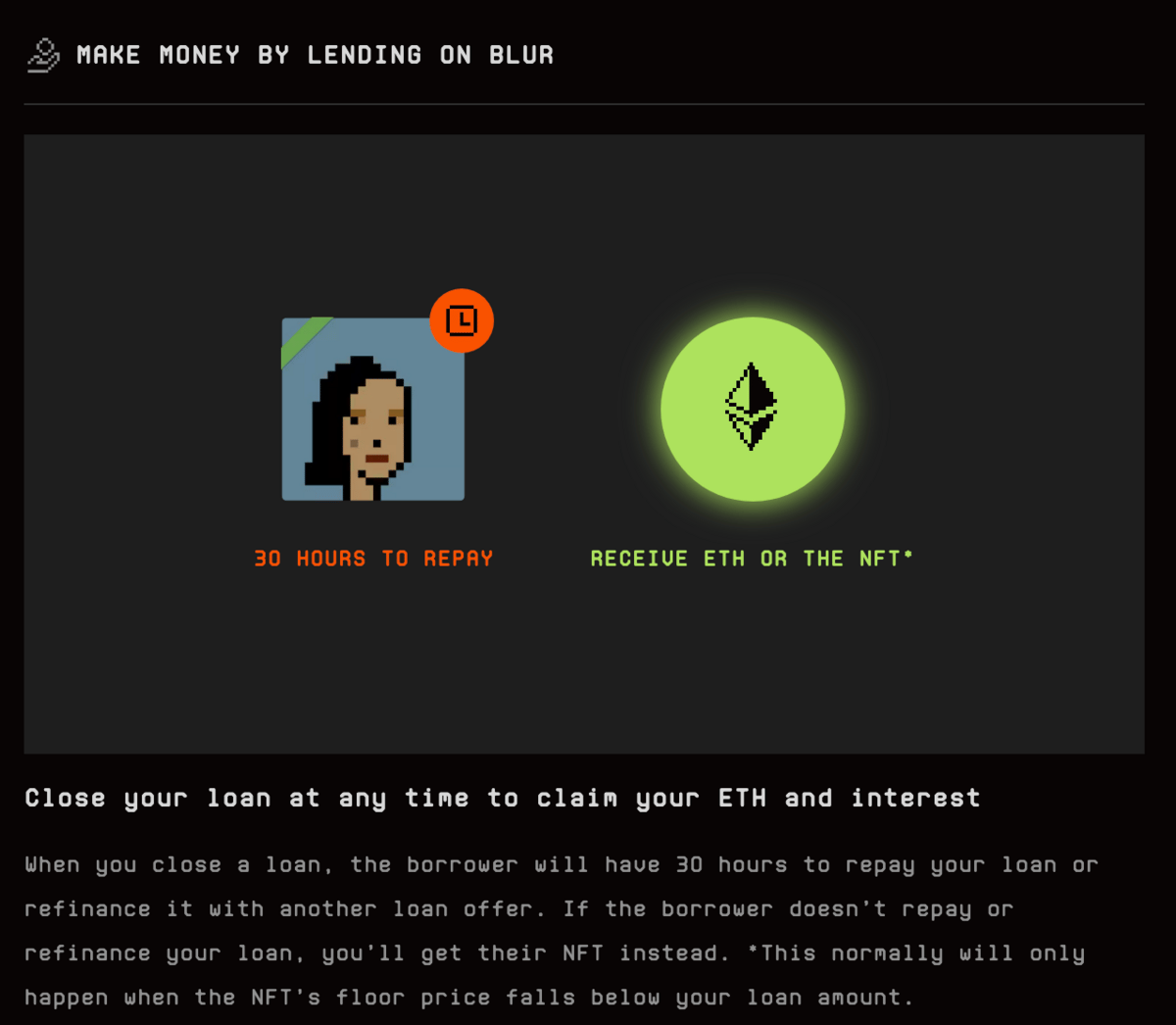

Instead, it’s a daily APY interest rate where the lender can choose to close the loan at any given point, giving the borrower 30 days to pay it off or refinance with another loan - essentially putting most of the risk on the borrower:

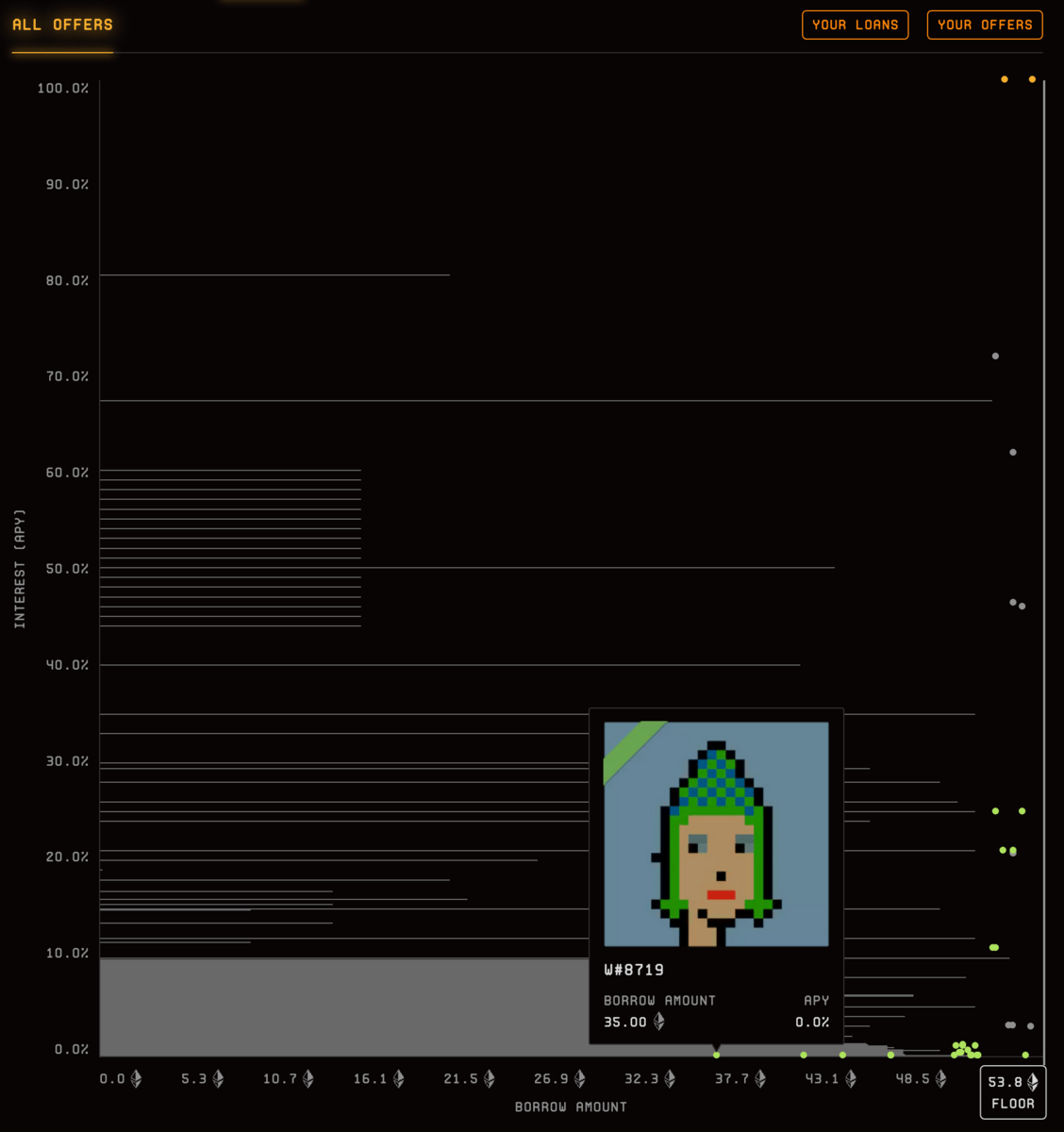

If we look at the Punks collection, right now you can borrow at 100% LTV but at a 995% APY, or borrow at 0% APY (lenders max their lending points by doing this) but only borrow at 65% LTV:

A super high LTV % of your NFT is effectively an option to default on the loan for free - it’s giving you cheap funding rate leverage.

This could be a very interesting tool to deploy when volume comes back in the next bull market, or around what you think will be big news events, acting essentially as a call option (with interest).

The flipside of borrowing is a new buy now pay later (BNPL) offering, below is how someone bought an Azuki listed at 15.9 ETH for just 2.2 ETH down:

-An Azuki was listed for 15.9 ETH

-I was able to buy it for 2.2 ETH, with a lender from the Azuki Blur lending pool fronting the rest

-I accrue a daily interest rate to keep it

-I have limited control over the NFT until I either pay off the principle + interest or sell the NFT— #TylerD 🧙♂️ (#@Tyler_Did_It)

8:16 PM • May 1, 2023

And if you just want to bet that the price of NFTs will go up or down, there are some PERPs for that.

🐸 Voting on Opepen Sets

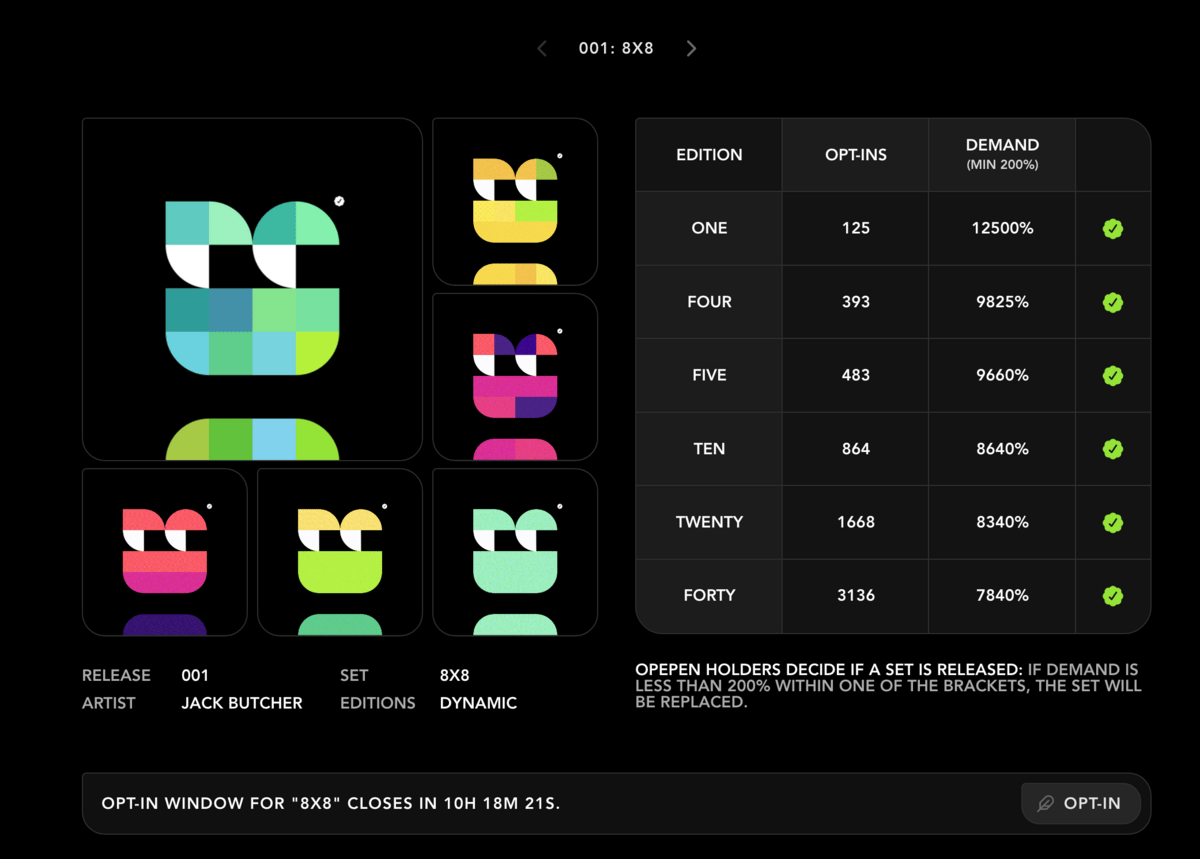

Over the last week, Jack Butcher announced that the artwork for Opepen will be in sets of 80 that holders (like me) can opt into:

opepen tldr

→ every opepen has a preset edition size

→ opepen are revealed in sets of 80 (200 sets total)

→ you opt-in to sets you like (artwork preview)

→ sets only drop if there is a 200% opt-in ratequestions?

— #Jack Butcher (#@jackbutcher)

7:15 PM • Apr 30, 2023

He’s now revealed the first two sets, the first one named 8×8 after the geometry that rules the entire system:

I opted into this one, but it’s of course massively oversubscribed, so it’s down to a lottery to see if I win and my metadata gets changed to one of these.

CLASSIFIEDS

Digital Asset Investor Manual is becoming the most comprehensive guide to investing in digital assets. It’s now at over 7,500 words (no fluff), plus screenshots and videos. Check it out.

Looking to sell your micro-startup or side project? Microns is a marketplace to buy the best micro-startups without commission. Join 4,000+ entrepreneurs and investors looking for their next deal in their weekly newsletter. Check them out.

beehiiv was founded by some of the earliest employees of the Morning Brew, so they know what it takes to grow a newsletter from zero to millions. You get built-in referral functionality, customization, and analytics where you can see the results of paid acquisition. Check them out.

DOMAINS

This was an interesting exact match domain sale that came up in my timeline. freebitcoinNFTs.com (i.e. Ordinals) was hand registered and sold for $2K, but the term does not have any search volume showing at Ubersuggest:

Domain sold @Undeveloped.

Ns1.Dan

Hold time weeks

Inbound

GL to the buyer

Pretty self explanatory domain

Still holding a few gems— #RVA Movers (#@MoversRva)

2:22 PM • May 3, 2023

Instead it is just forwarded to freenft.com.

This got me thinking.

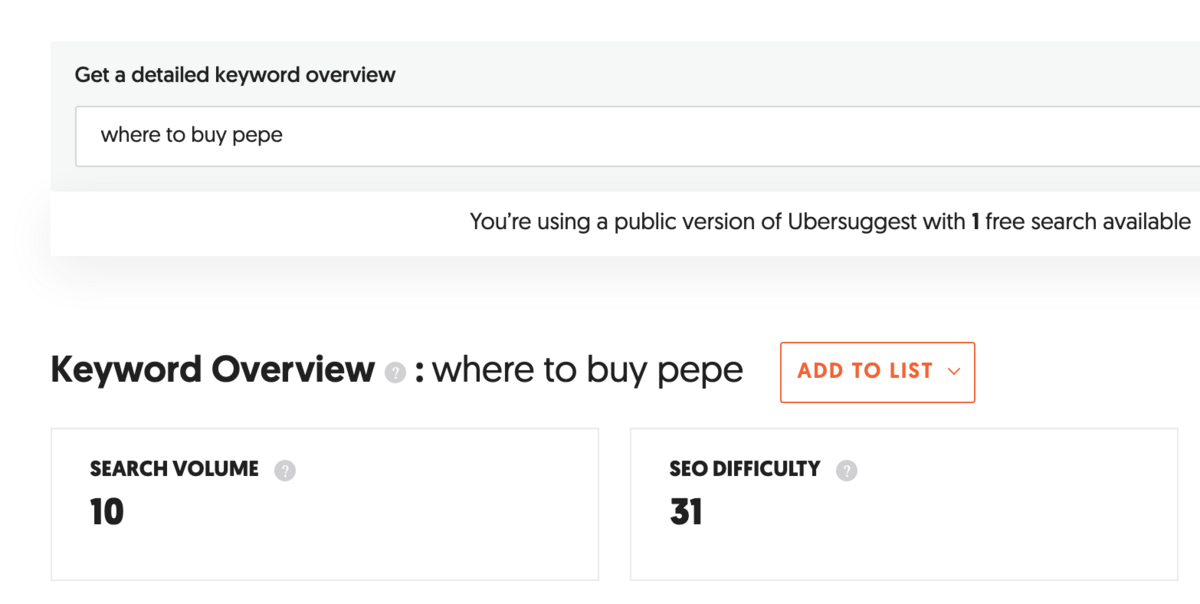

I missed out on the $PEPE memecoin crypto pump last week, but then thought maybe I should try to rank for “where to buy pepe” (I previously ranked #1 for “how to buy altcoins” back in 2017).

It’s showing as having some traffic:

Instead, I just picked up wheretobuypepe.com which is now listed for $2,111!

Interested in reaching 3000+ subscribers with your message?

Disclaimer: Nothing in this email is financial advice and I am not a professional investment adviser. I send weekly updates on digital asset news and what I'm doing personally - consider it informational and for entertainment purposes only. This newsletter is monetized through sponsorship, affiliate revenue and my own products.