Coming up in this issue...

Hey there 👋,

In a former newsletter life, I used to curate the top listings across the marketplaces. Previously this was in the Acquire The Web newsletter I sold as a package to Scott Oldford, which Aurelie at Duuce is continuing to run well (this week’s issue).

I’ve not done this format of email for a couple of years. But now that I’m actively looking everyday on the marketplaces for 7 and 8 figure deals that meet the buy side mandates I have at Patey Capital, it’s no extra work for me to start tracking and featuring here.

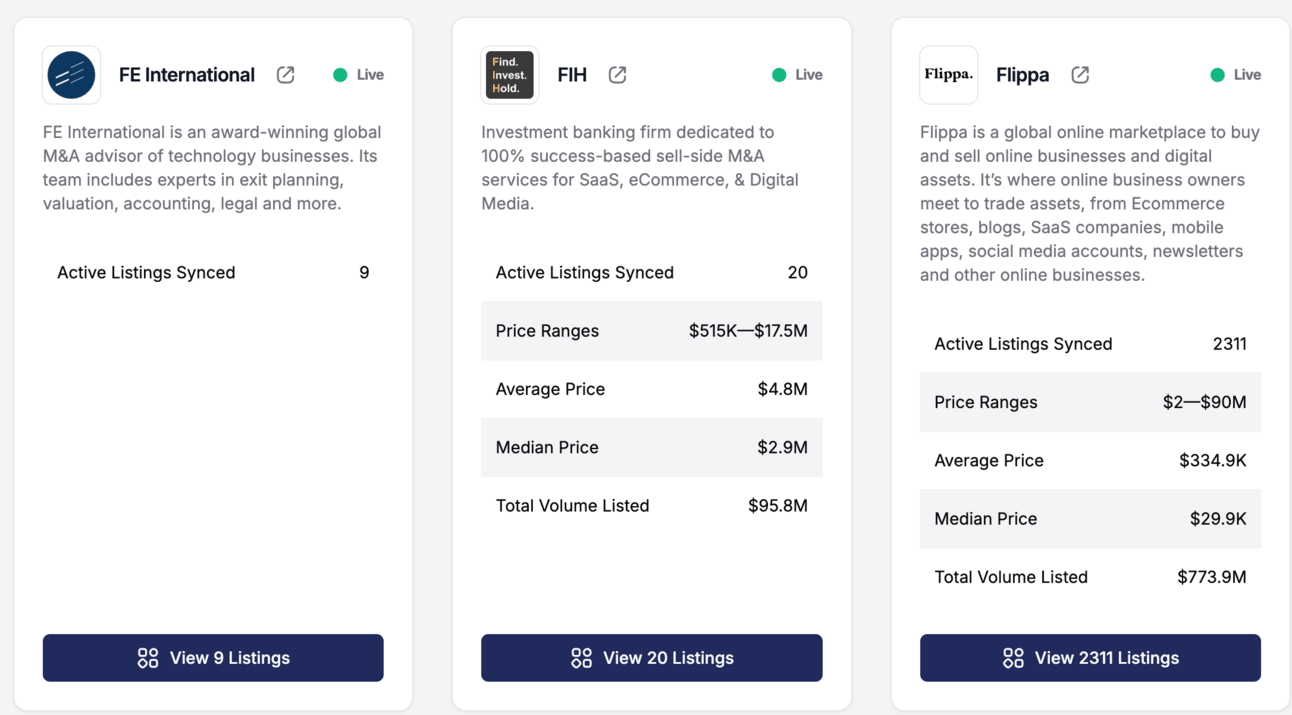

Ross Gerson (ex Empire Flippers) is doing a great job with his Acquiring Digital platform, bringing all the marketplace listings together (like Centurica’s Marketwatch). What’s really interesting is that under the broker section on his platform you can see the total volume of deals listed:

I spoke with him this week, and he stated that it’s not yet perfect as it doesn’t include Flippa’s 21 day first access for Premium customers. And also FE International’s volume is not showing up as they moved from listing prices to now only stating revenue and require you to request a CIM.

So I’m going to start tracking this manually again each week, and it’s time to bring back Patey’s Pie Chart™.

With FE International, most of their listings are SaaS so I looked at their SaaS valuation guide where 7x multiple on EBITDA is in the middle of their range. But they also include service based businesses so I’ll reduce this to 6x. As only a few of their listings state profit margins, I’ll be taking an average 29% mentioned in this guide, but rounding up to 35% to include other business models. That gives FEI a total gross merchandise volume of ~ $102M.

So how does that fit in with the biggest brokers/marketplaces according to data from Acquiring Digital?

Flippa - $773M publicly + $8.6M first access = $781M

Investors Club - $648M ($420M is one ecom deal)

Acquire.com - $459M

Foundy - $297M

FE International - $102M

FIH - $95M

Empire Flippers - $70M

QuietLight - $58M

Boopos.com - $20M

And here’s that pie chart I’ll be tracking each week…

Disclaimer: This is not super accurate, I’m not using APIs or scraping, I’m using publicly available information. I’m also not trying to paint any marketplace in a bad light, please don’t threaten to sue me (again), I’ll happily update anything that’s incorrect.

🤝 Flippa 7-Figure Deals Unlocked

Here are the top deals (in terms of interest/upside) I unlocked on Flippa this week with my Flippa Premium membership - get 3 months for free using this link and bypass NDA approval.

🛒 Ecommerce: Children’s travel product sold through Shopify store, I want one for my kids - $4.1M asking price (3.2x annual profit multiple) - Listing URL

🛒 Ecommerce: Adult paint by number kits on Shopify, upside in upgrading both the design & domain - $4.7M asking price (3x multiple) - Listing URL

🛒 Ecommerce: Accessory that keeps bed sheets in place, omnichanel including Shopify where I like the bundles - $4.2M (4.5x multiple) - Listing URL

🛒 Ecommerce: Health food product, own design/IP (looks great), omnichannel - $2.1M asking price, (3.7x multiple) - Listing URL

🛒 Ecommerce: Supplement brand on Shopify with $60K+ recurring subscriptions - $2.3M asking price (3.9x multiple) - Listing URL

🛍️ Amazon FBA: House & vehicle utility products, sounds well automated - $2M asking price (3.2x multiple) - Listing URL

☁️ SaaS: Mobile app business. I don’t know about code but there’s upside improving the marketing site - $2.4M asking price (4x multiple) - Listing URL

💼 Agency: Listing category is SaaS, but it’s a web agency with 42% profit margin - $2.3M asking price (4.8x multiple) - Listing URL

🧑💻 Service: Smart contract audit company working across range of blockchains - $2.6M asking price (2.3x multiple) - Listing URL

📰 Digital Asset Industry News

This one deserves more than a one line story!

Matt Mullenweg, the co-founder of WordPress and CEO of Automattic, gets in a spat with managed hosting platform WP Engine. He claims its profiting off the WordPress trademark and open source software, as well as swapping out the Woocommerce Stripe account.

Matt states in his blog post yesterday that WPE have been violating WP’s trademarks for years and he “drew a line in the sand”. WP.org has now blocked WPE customers form updating and installing plugins!

This is huge, I used to be a WP Engine customer and this would really suck! (I now use Rocket). And now Automattic which owns the hosting company Pressable is now offering WPE customers the chance to break free from their contract and they will credit the remaining contract value:

I’m a bit slow on the up take but what am I missing?….

>Founder of WordPress isn’t happy WP Engine is using WordPress trademark and not donating back to the open source project (WP Engine does 400MM a year in revenue hosting WP sites but has donated $0 back to WordPress)

>WP… x.com/i/web/status/1…

— #Mike (Niche Twins) 🏴☠️ (#@NicheDown)

12:55 PM • Sep 26, 2024

🌅 Jules acquires Keyword Metrics, rank-tracking SaaS from Ian Nuttall (Link)

🦃 Is Forbes Marketplace stuffing CNN & USA Today full of affiliate content too? (Link)

🤖 Cloudflare’s marketplace will let websites charge AI bots for scraping (Link)

🛠️ Top 3 Solutions Worth Checking Out

DOMAIN INVESTORS - Start the conversation with a .chat domain name from Porkbun! It’s perfect for customer service, sharing info, chatbot assistance, and so much more. Get a .CHAT domain name for less than $2 for the first year now.

💼 ONBOARD CLIENTS IN MINUTES - Automate the onboarding in your digital agency. Create a smooth journey for your clients, and reduce the admin load on your team. One spot left for next week.

🏖️ SKIP THE GOOGLE SANDBOX - Odys offers premium and brandable aged domains that can get your new website ranking quickly. Open a new account and get $100 credit to shop for your perfect domain.

🧑🤝🧑 Digital Asset Marketplace Posts

Our community marketplace has over 250 members (it could have double but we’re strict on entry!) discussing and selling digital assets, plus free (and paid) classes:

Below are the top posts over the last week:

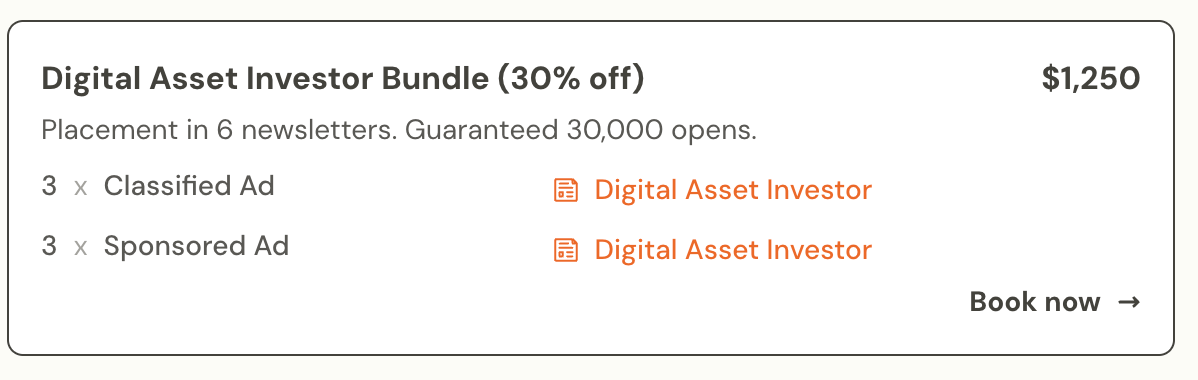

📣 Sponsor This Newsletter

That’s it for this week, until next time, catch me in the community.

Cheers!

Richard (@richardpatey)

Disclaimer: Nothing in this email is financial advice and I am not a professional investment adviser. I send weekly updates on digital asset news and what I'm doing personally - consider it informational and for entertainment purposes only. There are likely affiliate links in this issue.