Together with

Hey there 👋,

In this week’s newsletter, I discuss:

Expired ENS domains come at a $100M premium

The #1 Website Broker on Flippa

Newsletters becoming more of an asset class

The rise (Opepen) and fall (Moonbirds) of PFPs

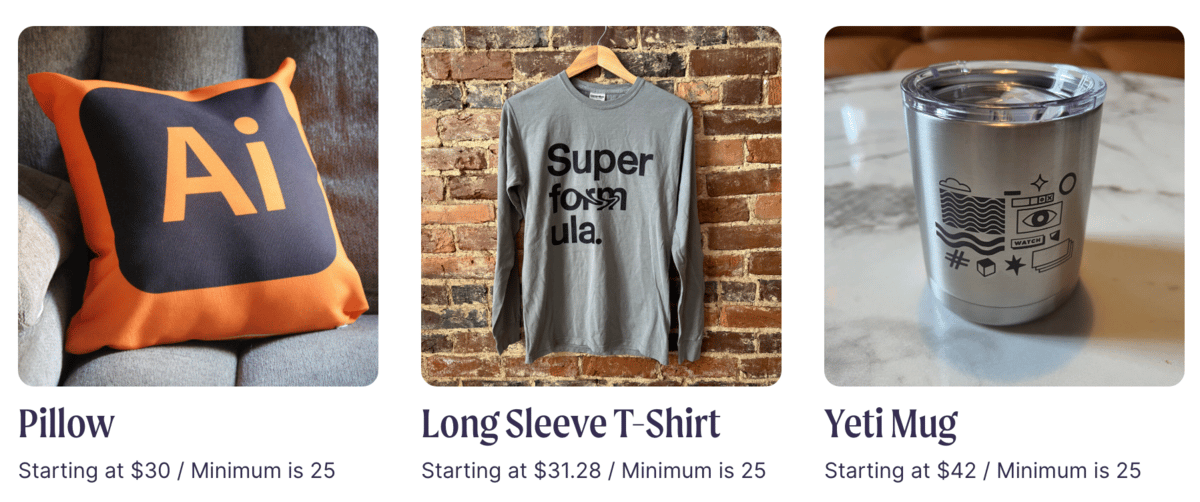

Over the last week I’ve been working with a pixel artist to create a much better logo for this newsletter that can work on top quality merchandise I’ll be giving away soon as referral rewards (I love the pillow):

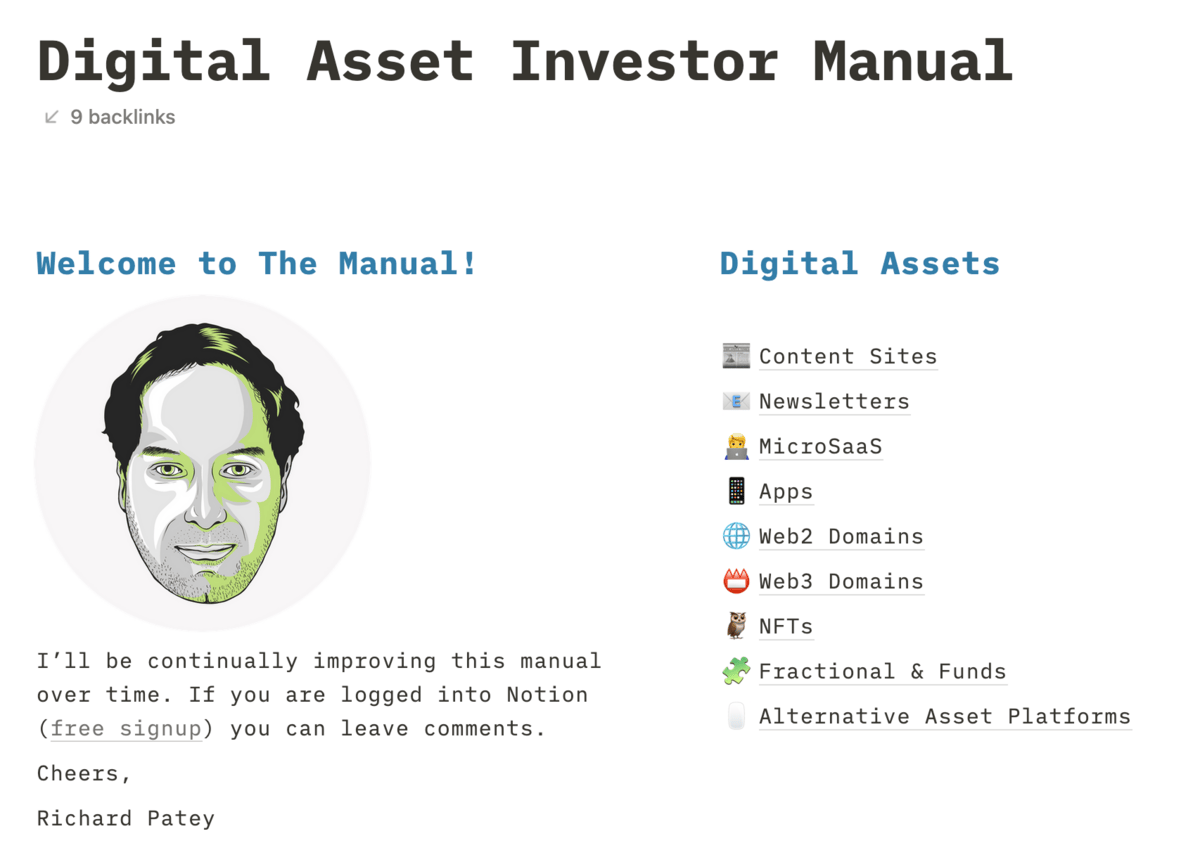

And I’ve been working on the Digital Asset Investor Manual, to make it the most comprehensive guide to investing in digital assets. It’s now at over 7,500 words (no fluff), plus screenshots and videos:

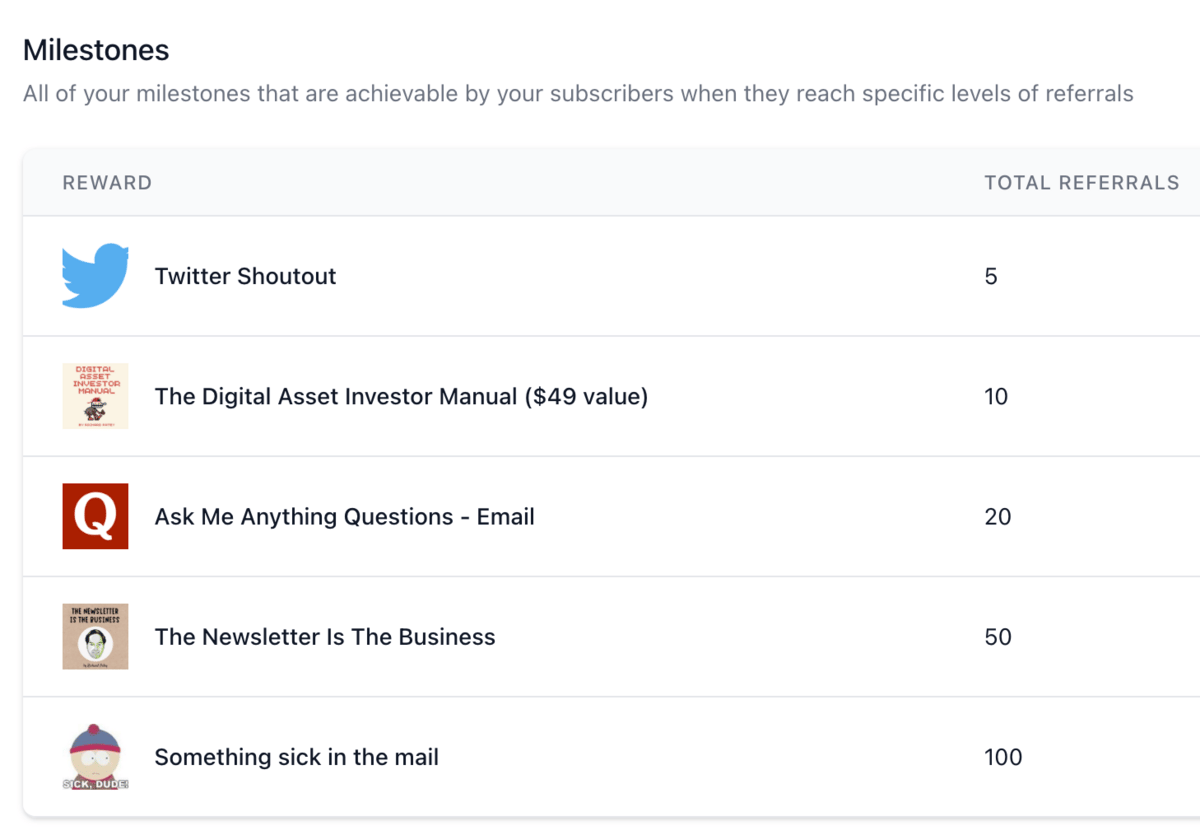

As such I’ve increased the price from $29 to now $47, or free if you refer 10 people to this newsletter (I’ve added a new referral reward). I’ve also increased the price of the Acquire The Web Manual for my other newsletter on beehiiv from $47 to $97. I kind of like this model of building value in public.

Cheers!

Richard Patey - @richardpatey

DOMAINS

In a previous newsletter I mentioned looking to pick up ENS (.eth) domains that were expiring 12 months on from the craze last year.

Well that time is now, and some people who have been using their .eth for their twitter handle and let it unknowingly expire are not happy:

Daily reminder to renew your ENS name

If you let it expire it's no longer yours

— #anon.eth (#@player1_eth)

1:05 PM • Apr 17, 2023

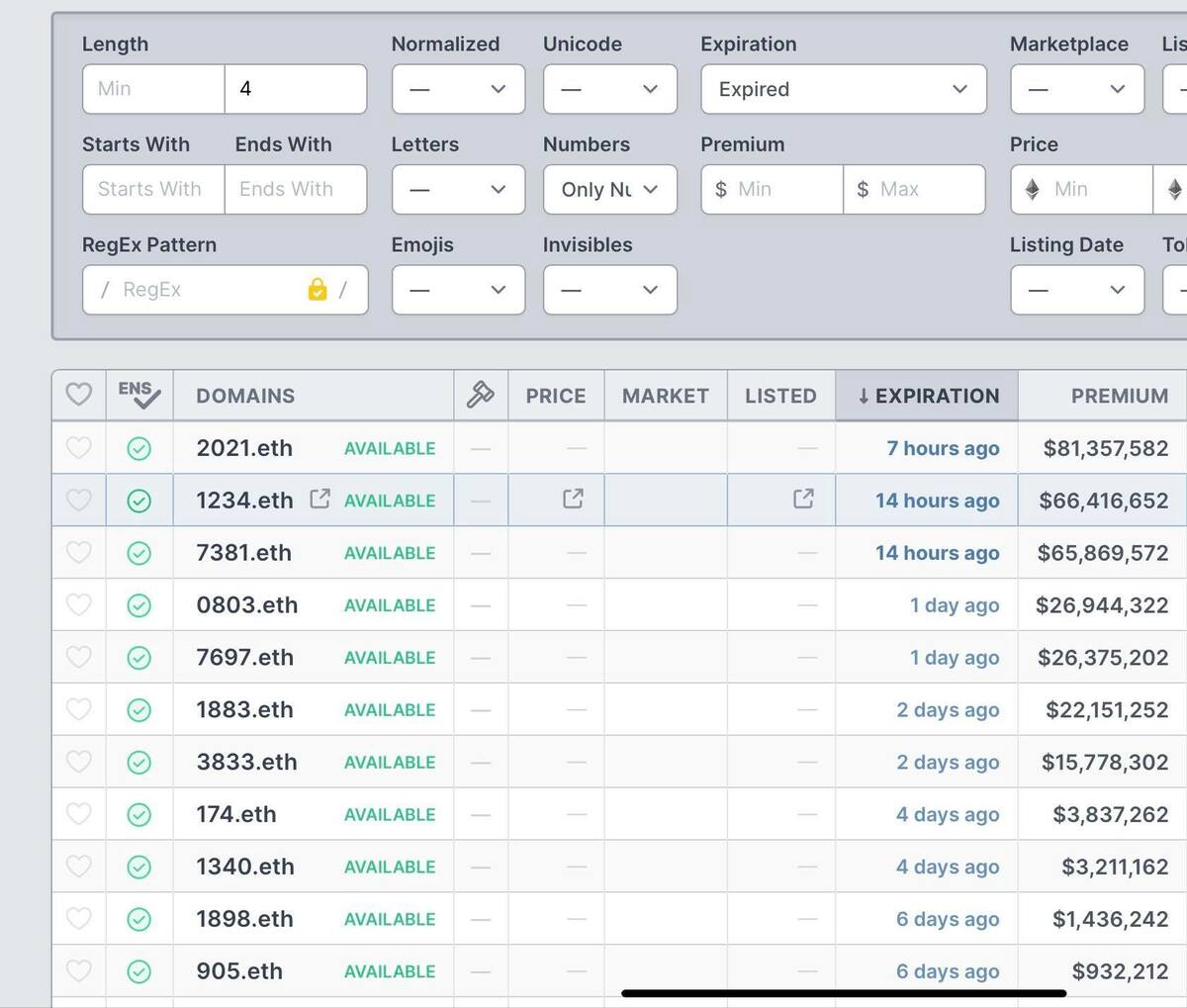

If you got to ENS.Tools you can find all kinds of names expiring or already expired. I wanted to see if I could pick up a 4 digit one, part of the 10K club whose floor has now dropped as low as 0.54ETH:

So I used this filter where you can see that 2021.eth is expiring in a few hours time:

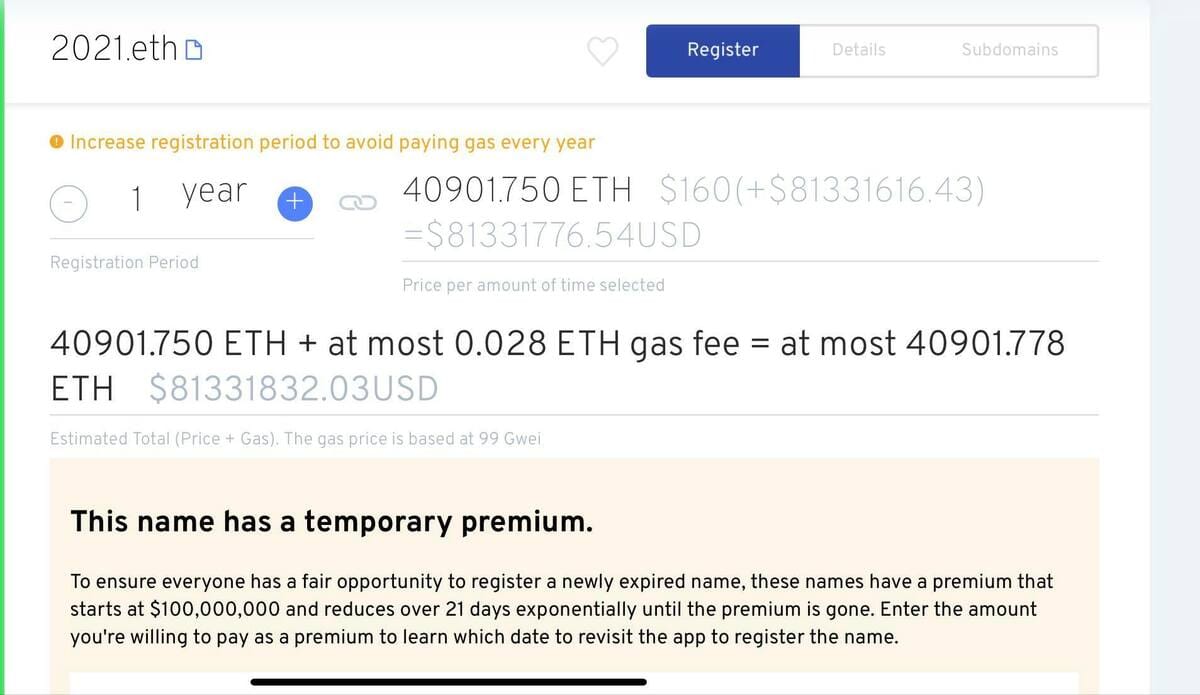

The only issue is that there is a temporary $100M (!) premium attached to all newly expired names (I did not know this) and it’s currently priced at over $80M:

I’m not sure how you can snipe one of these without others knowing…

CONTENT SITES

🚀 The #1 Website Broker on Flippa

Thinking of listing your website on the Flippa marketplace? Or already listed, but not getting any serious offers?

Joe Burrill and his team at Just Website Brokerage will be able to change that for you. They don't do listing fees and only charge when they successfully find you a buyer.

If you choose them you will get:

A trusted account with 10 years of history, $3.5M transacted across 162 deals, 100% positive feedback, and thousands of watchers

An optimized listing page with all sales info and attachments, plus use of their legal documents used on 100’s of deals

A listing manager that will field all messages, comments, bids and sales calls with buyers

Promotion to their email list with thousands of buyers

Thanks to Just Website Brokerage for sponsoring this issue 🙏

Over the last week there’s been a lot going in with newsletter investments.

First up Anthony Castrio announced that he had sold 20% of his 3000 subscriber newsletter for $10K, valuing it at $50K:

I sold 20% of the Bot Eat Brain newsletter to @DBogachek for $10,000. AMA.

— #Anthony Castrio (#@AnthonyCastrio)

2:00 PM • Apr 13, 2023

@DBogachek The newsletter is treated as an asset that we share. Future revenues will be split 80/20, but all decisions are still up to me including when/if we take money out.

— #Anthony Castrio (#@AnthonyCastrio)

2:37 PM • Apr 13, 2023

He states that the valuation was closer to $30 per subscriber due to how fast the newsletter was growing (although that would have made the valuation $100K):

@DBogachek Started from a basis of $15/subscriber, and negotiated from there to more like $30/subscriber because of how fast the newsletter is growing.

— #Anthony Castrio (#@AnthonyCastrio)

2:40 PM • Apr 13, 2023

This is very impressive seeing as when I’m valuing newsletters I’m looking to buy, I’m aiming for $2-3 per open (rather than per subscriber).

Then Mike Cardona announced that he had done a similar deal:

Pretty crazy considering just yesterday I sold 10% of the newsletter for the same amount to @gjsequeira

what are the odds? 😳

This is going to be fun 😎 @AnthonyCastrio

— #Mike Cardona {Automation Alchemist 🧪} (#@CSMikeCardona)

4:02 PM • Apr 13, 2023

With someone asking if this is like fractional ownership of newsletters.

I personally had an offer of investment for equity in my website investing newsletter back in 2020, but instead chose to sell 100% which all went in my pocket, which is my preference.

And then just yesterday, Dan Kulkov, the co-founder of Makerbox announced that he had sold 100% of his Sponsor This Newsletter product:http:

We sold our first product — Sponsor This Newsletter 🔥🎉

• Launched 6 months ago

• 100% No-code

• Sold for 5 figures 💪Excited to see @scottoldford grow it to the next milestone.

Special thanks to @acquiredotcom for being the best platform to sell indie startups ❤️

— #Dan Kulkov 🧲 (#@DanKulkov)

6:16 PM • Apr 18, 2023

The buyer was Scott Oldford, serial entrepreneur and investor and now founder/CEO of The Wisdom Group, which has a portfolio of 30+ companies.

Due to all of this, Paul Metcalfe has even added a new channel in his excellent Lettergrowth Lab community:

Added a channel in the community for buying, selling and investing in newsletters.

— #Paul Metcalfe (#@pauldm)

8:39 PM • Apr 17, 2023

Classifieds

Looking to sell your micro-startup or side project? Microns is a marketplace to buy the best micro-startups without commission. Join 4,000+ entrepreneurs and investors looking for their next deal in their weekly newsletter. Check them out.

beehiiv was founded by some of the earliest employees of the Morning Brew, so they know what it takes to grow a newsletter from zero to millions. You get built-in referral functionality, customization, and analytics where you can see the results of paid acquisition. Check them out.

NFTS

💎 The rise and fall of PFPs

It’s been an interesting week with Jack Butcher’s assets.

Checks - VV Edition (the unmigrated version) is down to a 0.439ETH floor, the (migrated) Checks - VV Originals are down to 0.3ETH and Opepen was as high as 0.444ETH yesterday, potentially flipping Checks VV. It’s now consolidating at 0.4ETH.

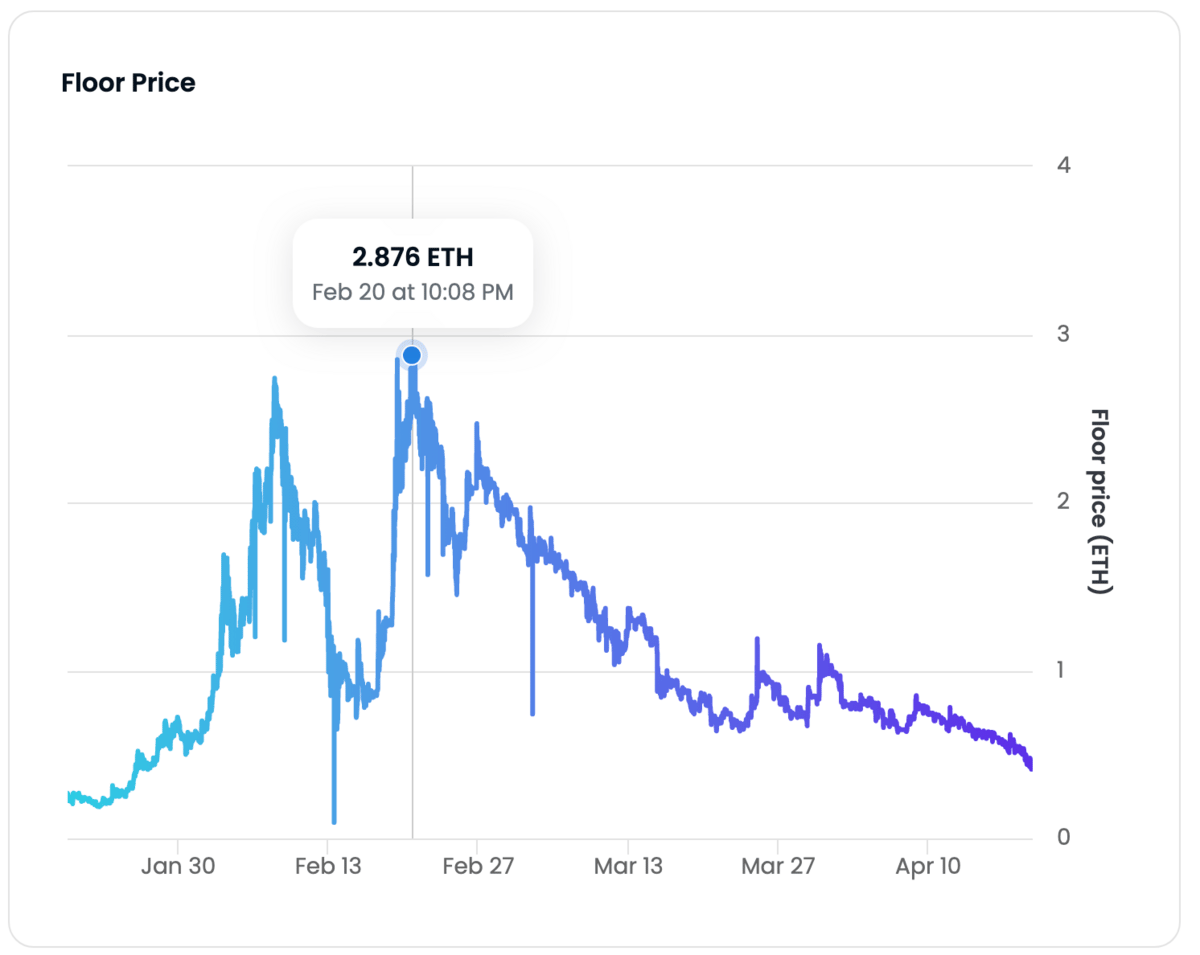

This is crazy to see, seeing as the bluechip Checks (VV) was as high as 2.8ETH floor back in February:

It all comes down to the fact that the market likes and understands PFP projects, which Opepen is about to become. Jack tweeted yesterday that he has now made the collection a round 16K, with the reason being something to do with packs:

@visualzare @iamng_eth @Lost4theCause first - the reason for getting to an even 16k, clean math

16,000/80 = 200

✅

— #Jack Butcher (#@jackbutcher)

2:15 PM • Apr 18, 2023

This got the market excited, and some see this as being the CryptoPunks of AI generated PFPs:

CryptoPunks is the iconic PFP of generative traits-based NFTs.

I think @jackbutcher's Opepen has a good chance of becoming the iconic PFP of AI.

— #Bart (#@bart_hillerich)

1:18 PM • Apr 19, 2023

I’m certainly holding my one remaining (after farming a bunch on Blur).

So that was the rise and here comes the fall.

After spawning Mythics Eggs yesterday (which have a slight premium on Oddities), Moonbirds are almost back to their 2.5ETH mint price:

Wow looks like the market priced in Mythics Eggs

Moonbirds has now almost gone back to mint in ETH, 2.89 on opensea, 2.86 on blur (and obviously under in terms of USD)

— #patey.eth (#@RichardPatey)

2:39 PM • Apr 19, 2023

It’s insane to see how such a well funded project with all the wind in its sails has round tripped.

Ok, that’s it from me, until next week, be well and share this newsletter to get my referral rewards:

Interested in reaching 4200+ subscribers with your message?

Disclaimer: Nothing in this email is financial advice and I am not a professional investment adviser. I send weekly updates on digital asset news and what I'm doing personally - consider it informational and for entertainment purposes only. This newsletter is monetized through sponsorship, affiliate revenue and my own products.