Hey there 👋,

I killed my personal newsletter, instead each week I’ll now be adding my own update at the start of this newsletter. I’ve also added a new Crypto Corner section as we position for a blow off top next year. But feel free to use the table of contents (on the web version) to go straight to the deals and news.

Coming up in this issue...

📝 Patey’s Update

As mentioned I deleted my personal newsletter (too quickly, the links in my final send didn’t work!) and moved my paid community from Skool back to Discord. I think you do need live chat for a private community, and a great one I’ve recently joined is Advise.so on Slack where I’ve been learning more about parasite SEO. I’ve started ranking posts on Reddit, but as am new to doing this have already been called out for spamming, self promotion and for using my new co-branded beehiiv landing page in the beehiiv subreddit (here’s the post)!

I’m also considering selling the Digital Asset Marketplace Skool community - I think it would be a good pick up for an M&A advisor or service provider (just hit reply if interested).

I’ve started building my own content sites again, something I’ve not done since 2018. I’m publishing again on my DR51 richardpatey.com as well as back on my ski domain snowbistro.com. I XML imported previous content I generated from Content at Scale (now Brandwell) and I’ve been using Cuppa to create new content (using my own OpenAI and Perplexity API keys which keeps the cost down) which I edit and add expertise to.

It really is incredible not needing to pay for writers anymore with websites. And this is something that me & Maciej have now solved for newsletters by creating our own prompts and custom GPTs to deliver the Letter Operators productized service which is now scaling at the new $500/m price point. I guess you have to just keep dropping the price until people open up their credit card. We started at $5K/m when newsletter sponsorship CPMs were $30, now they are $3 so it makes sense.

I’ve also fractionalized myself as an CMO if you know of anyone looking to scale.

And I’m in the process of selling the This Week In Solana newsletter so that I can focus on just this one.

📊 Marketplace GMV

This week’s there’s $4.4B worth of listings over the top 12 marketplaces/brokers I’m now tracking using data from Acquiring Digital:

I think Flippa will always be top as many brokers like Latona’s list their deals on the platform, so total GMV is inflated / double-counted, but it’s still the most interesting public metric to track each week:

Position | Broker | Total GMV Listed | 7 Day Change |

1 | Flippa | $827,800,000 | $3,500,000 |

2 | Investors Club | $656,700,000 | -$24,500,000 |

3 | Latona's | $620,600,000 | -$11,700,000 |

4 | Acquire | $507,900,000 | $24,300,000 |

5 | Website Properties | $581,600,000 | $0 |

6 | Website Closers | $448,300,000 | -$13,000,000 |

7 | Foundy | $222,600,000 | $0 |

8 | Merge | $173,600,000 | $0 |

9 | App Business Brokers | $139,300,000 | $0 |

10 | FIH | $97,100,000 | -$9,800,000 |

11 | Quietlight | $84,900,000 | $0 |

12 | Empire Flippers | $72,200,000 | -$600,000 |

Disclaimer: This is not super accurate, I’m not using APIs or scraping, I’m using publicly available information, I’ll happily update anything that’s incorrect.

🤝 Flippa New Deals Unlocked

There are currently 133 (+18 on last week’s count) 7-figure deals on Flippa and I’ve come across four new ones since last week, which I was able to unlock with my Flippa Premium membership - get 3 months for free using this link and bypass NDA approval.

👨💻 Digital Agency: General purpose agency vs niched, apparently bringing in $57K/m but I have no idea how, the brokered listing says has high traffic but no search traffic is showing in Ahrefs. Service delivery is done in Asia. $2.5M ask, 3.6x profit multiple - Listing URL

☁️ SaaS: Platform for call centres, where the brokered listing says AI growth potential, that is if AI doesn’t kill call centres. Either way, you may not find the 20x profit multiple on this on attractive, $1.5M ask - Listing URL

🛒 Ecommerce: This is a custom print business on Shopify (similar to mine) built from SEO traffic (like I did), and at a 3.5x profit multiple so I instantly approve. It’s ranking for almost 5K keywords, its top page bringing in 30% search traffic and ranking #6 so some page dependency here. But it’s the homepage, so you’d just need to create an inner page targeting this KW and internal link it up. It’s making $32K/m, $1.35M asking price - Listing URL

🛒 Ecommerce: Herbal tea Amazon FBA business. One if its bestsellers is ~ #20 for herbal teas on Amazon US, and benefits from subscribe & save. It’s run by one FTE staff in China, averaging $42K/m, with 4.4x profit multiple which is on the higher side, $2.5M ask - Listing URL

There are currently 597 (+12 on last week) 6-figure listings on Flippa and looking like nine new ones from what I saw last week - I’ve picked this ecom one to feature:

🛒 Ecommerce: Nice simple business this: 2 main products in pregnancy niche, promoted organically on large Instagram and TikTok channels, fulfilled from China and run by a VA. Bringing in $22K/m, only asking for 1x annual profit at $215K asking price - Listing URL

Whiskey: A Hedge Against Market Volatility

Looking to protect your portfolio from the next recession?

Consider investing in rare spirits like whiskey.

Whiskey investing provides a proven hedge against stock market dips driven by inflation and other factors.

With Vinovest, you can invest in high-growth segments such as American Single Malt, emerging Scotch, Bourbon, and Irish whiskey. Thanks to established industry relationships, Vinovest overcomes industry barriers that have made historically whiskey investing expensive and opaque. As a result, you can enjoy high-quality inventory that boosts your portfolio value and enhances liquidity.

📰 Digital Asset Industry News

Don’t forget about Bing, Yahoo and DuckDuckGo - Link

A history of parasite SEO by Charles Float - Link

It appears that growth equity firm Three Ships have been working with a number of sites with partnership SEO, including a non-profit where they have been publishing product reviews:

is a nonprofit claiming to be “Your trusted guide to mental health & wellness.” But they decided to sneakily rent their trusted domain to a company called Pillar4 Media (owned by Three Ships) in order to sell mattresses, beds, hearing aids, ED treatments, etc.

— #Goog Enough (#@Goog_Enough)

1:27 PM • Oct 21, 2024

Jacky from Indexy goes into this in more depth, it’s impressive:

🛠️ Top 3 Solutions Worth Checking Out

💬 DOMAIN INVESTORS - Start the conversation with a .chat domain name from Porkbun! It’s perfect for customer service, sharing info, chatbot assistance, and so much more. Get a .CHAT domain name for less than $2 for the first year now.

👀 YOUR NEWSLETTER, RUN FOR YOU - Letter Operators runs your newsletter on beehiiv so you don’t have to. Content sourcing, creation and publishing, with calls-to-action for your products and services. Weekly sending at just $500/m.

🏖️ SKIP THE GOOGLE SANDBOX - Odys offers premium and brandable aged domains that can get your new website ranking quickly. Open a new account and get $100 credit to shop for your perfect domain.

🔗 Crypto Corner

With the bull market just around the corner, it would be amiss of me not to at least mention one thing each week going forward. Given the 4 year nature of the Bitcoin halving, it sure looks as if it’s ready for a strong upward move, similar to October 2020…

VaultCraft launches V2, Skyrockets to $100M+ TVL

VaultCraft debuts new Safe-secured platform, wins $100M+ Bitcoin commitment

Leading crypto platform Matrixport chooses VaultCraft for $100M Bitcoin

Launching 7 new yield vaults on OKX Web3 with $250K+ in rewards

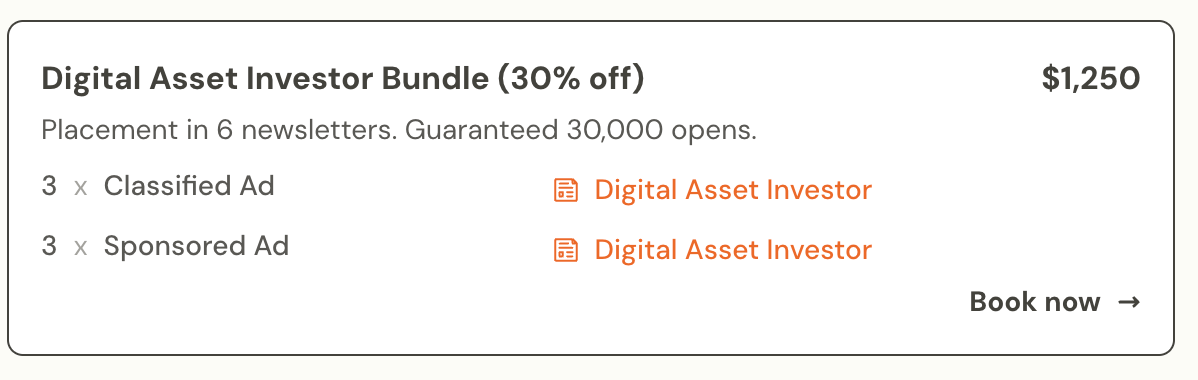

📣 Sponsor This Newsletter

That’s it for this week, until next time

Cheers!

Richard (@richardpatey)

Disclaimer: Nothing in this email is financial advice and I am not a professional investment adviser. I send weekly updates on digital asset news and what I'm doing personally - consider it informational and for entertainment purposes only. There are affiliate links in this issue to listings and products.