Hey there 👋,

In last week’s email I stated that I’d been thinking about getting back into M&A advisory again.

I’ve now launched Patey.Capital and have started finding:

Buyers for a €3M revenue, €500K EBITDA supplements business which could make a great bolt on for a larger nutrition company

Sub €5M deals in interior design and furniture, Europe wide, for a UK based ecommerce business

(Hit reply if either sound interesting).

I offer full advisory for 7 figure revenue businesses, including scale up support prior to an exit. I look to boost profitability by lowering acquisition cost through newsletter and community funnels, and reducing operational overhead by leveraging AI.

If you’re looking to scale and exit, or acquire a 7 figure asset, just get in touch and we can get on a call.

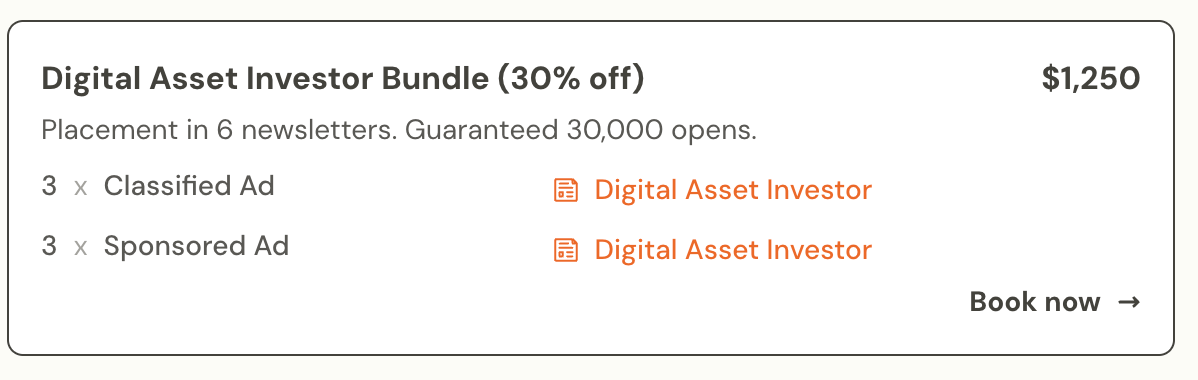

Or you could consider fractional investing in WebStreet who is this week’s sponsor…

📈 WebStreet’s Low-Capital, High-Return Model

If you’re looking to diversify your portfolio and access private equity without the typical high capital requirements, WebStreet offers something unique—their micro-private equity model.

Traditionally, private equity has been reserved for those with substantial funds and a willingness to actively manage their investments. WebStreet breaks those barriers, allowing accredited investors to start with just $60K and enjoy passive management.

By focusing on cash-flow-positive online businesses, WebStreet is on track to hit a 20% annualized return on investment, with the potential for significant exits within just 2-4 years.

Here’s what really stands out about their Micro-PE model:

Lower Capital: With a smaller initial investment, you gain access to returns typically reserved for large portfolios.

Expert Management: WebStreet’s vetted portfolio managers handle everything—from acquisition to growth to exits.

Diversified Portfolio: Your capital is spread across a range of cash-flowing online businesses like SaaS, Amazon storefronts, e-commerce, agencies, and more.

If you’re intrigued and want to learn more, WebStreet has an on-demand webinar on how their unique micro-private equity model works.

📰 Digital Asset Industry News

🦾 When a $10 domain purchase gets you over 100K views (Link)

🥱 Combine local newsletter with a boring business? (Link)

🔄 Content site success? Do the opposite of what Google says (Link)

🤓 NerdWallet drops 42% in organic search, and 15% of its workforce (Link)

☠️ Discord is dead, long live forums (Link)

🛠️ Top 3 Solutions Worth Checking Out

💬 START THE CONVERSATION WITH A .CHAT DOMAIN NAME FROM PORKBUN - It’s perfect for customer service, sharing info, chatbot assistance, and so much more. Get a .CHAT domain name for less than $2 for the first year now.

👀 YOUR NEWSLETTER, RUN FOR YOU - Letter Operators runs your newsletter on beehiiv so you don’t have to. Content sourcing, creation and publishing, with calls-to-action for your products and services. Weekly sending for just $750/m.

🤯 MANAGING WORDPRESS SUCKS - Use Work Hero so you don’t have to. 24/7 support, development & maintenance for a flat monthly fee. No contracts or surprises, Kevin the owner doesn’t do that crap. Tell him Digital Asset Investor sent you.

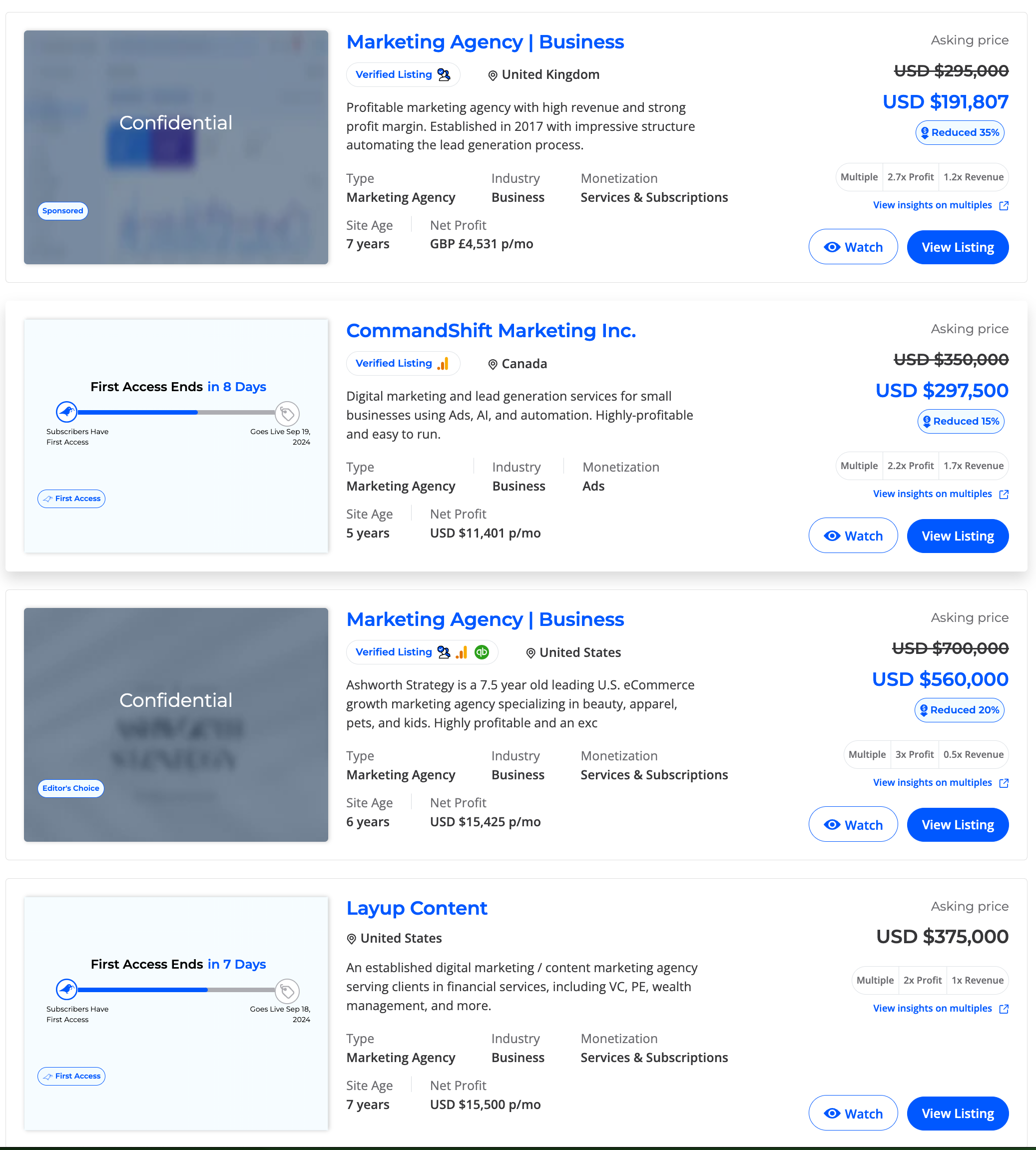

🧑🤝🧑 Digital Asset Marketplace Posts

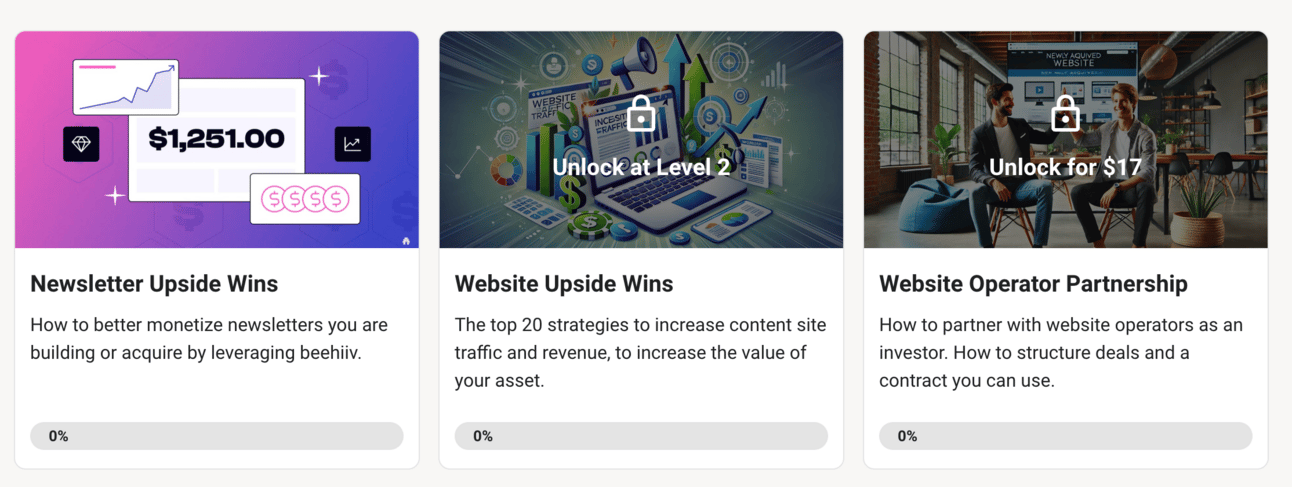

Our community marketplace has over 250 members (it could have double but I’m strict on entry!) discussing and selling digital assets, plus free (and paid) classes:

Below are the top posts over the last week:

That’s it for this week, until next time, catch me in the community.

Cheers!

Richard (@richardpatey)